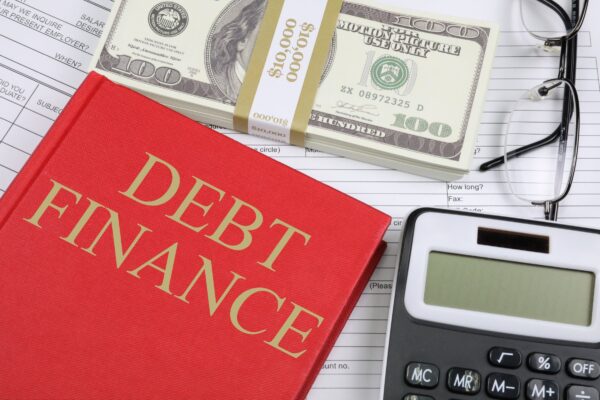

One important step in getting to grips with our personal finances is to make use of the tools available online on the Australian personal finance websites out there. A good finance calculator can help you with many aspects of your financial management, whether it’s calculating your future savings, calculating how much the banks might lend you for a home loan, calculating repayments on a car loan, calculating how long it will take you to pay off your credit card debt, calculating stamp duty or comparing home loans. These are just a few situations where a financial calculator can be a useful tool.

One of the most common forms of debt for Australians is credit card debt. If we are the type of person who manages their finances well, checks statements, and always pays off their debt within an interest-free period, then debt needn’t be a problem. However, does the average Australian look after their personal finances like this?

One thing we would urge people is to get a hold of their credit card debt and work towards paying it off as a priority so that it doesn’t become a problem further down the line. Use the Credit Card Reduction finance calculator to help you calculate what payments you need to make to get that debt paid off. A typical calculator will ask for your current balance and monthly payment. You will have to enter the current interest rate and the ideal period that you want to pay off the debt. It will then calculate the Current I/O payment, the current months to pay off the credit card, the current total interest paid, the new monthly payments required to pay off the debt in the period stated, and the interest payments you will save by doing this.

A similar financial calculator can help you work out how to pay off loans – be it a personal loan, a car loan, or a home loan – by making larger repayments. It will normally ask you for details regarding your present loan arrangement, then you enter your proposed new arrangement in terms of a new repayment amount or a higher or lower interest rate or a shorter or longer repayment period and it will calculate the effect this has on the loan. Please bear in mind that if you are using the finance calculator for this type of calculation then there may be extra fees that the financial institution will apply, which the financial calculator cannot take into account. You should use the calculator as a guideline only.

Another great personal finance calculator is a budget planner. With this, you will enter your income and expenses details and it will let you see where your money goes, how much is left to save, and how much more you can save in a year by spending less.