Position Sizing and Risk Management for NSE Option Chain Trading: Protecting Your Capital

The NSE Option Chain offers a dynamic and versatile platform for traders to capitalize on market movements and generate substantial profits. However, alongside the potential for rewards lies the inherent risk of significant losses. Position sizing and risk management are fundamental aspects of successful NSE Option Chain trading, enabling traders to protect their capital, navigate market uncertainties, and achieve their financial goals sustainably. Check what is demat?

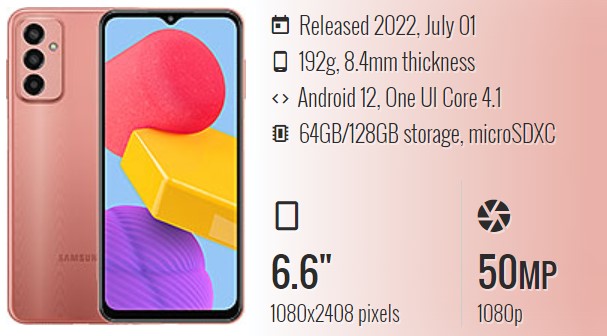

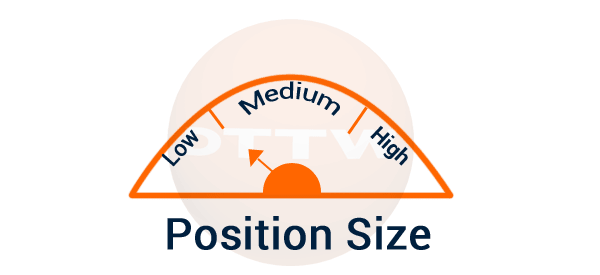

Understanding Position Sizing

Position sizing refers to the determination of the appropriate size of a trading position. It essentially involves calculating the number of contracts to be traded based on a trader’s risk tolerance, available capital, and the characteristics of the underlying asset and options contracts.

Factors Influencing Position Sizing

Risk Tolerance: A trader’s risk tolerance plays a pivotal role in position sizing. Higher risk tolerance allows for larger positions, potentially amplifying profits but also increasing the risk of significant losses. Conversely, lower risk tolerance necessitates smaller positions, limiting potential profits but also minimizing potential losses. Check what is demat?

Available Capital: The amount of available capital determines the maximum potential position size. Traders should never risk more than they can afford to lose. Overleveraging can lead to catastrophic losses if market movements go against expectations.

Underlying Asset Characteristics: The volatility and liquidity of the underlying asset influence position sizing. More volatile assets require smaller positions to manage risk, while more liquid assets allow for larger positions without impacting market liquidity. Check what is demat?

Options Contract Characteristics: Strike price, delta, and implied volatility of the options contracts also influence position sizing. Out-of-the-money options typically require larger positions to achieve meaningful profits due to lower premiums, while in-the-money options may require smaller positions due to higher premiums and potential for profit erosion.

Risk Management Strategies

Stop-Loss Orders: Stop-loss orders are crucial risk management tools. They automatically exit a position when the price moves against the trader, limiting potential losses. Traders should carefully set stop-loss levels based on their risk tolerance and market analysis.

Profit Targets: Profit targets are predetermined price levels at which traders exit a position to lock in profits. Setting profit targets helps discipline traders and avoid excessive greed, ensuring they secure profits before a reversal occurs. Check what is demat?

Risk-Reward Ratio: The risk-reward ratio measures the potential profit relative to the potential loss. Aiming for a favorable risk-reward ratio ensures that potential profits outweigh potential losses, increasing the likelihood of long-term success.

Diversification: Diversifying trading positions across different underlying assets and options strategies reduces the overall risk exposure. Diversification spreads risk, preventing a single adverse market event from causing substantial losses.

Emotional Control: Maintaining emotional control is essential for effective risk management. Traders should avoid impulsive decisions driven by fear or greed. Sticking to a well-defined trading plan and risk management strategy helps maintain discipline and avoid emotional mistakes. Check what is demat?

Conclusion

Position sizing and risk management are the cornerstones of successful NSE Option Chain trading. By understanding the principles of position sizing, employing effective risk management strategies, and maintaining emotional discipline, traders can navigate the complexities of options markets with greater confidence, protect their capital, and achieve their financial goals in a sustainable manner. Check what is demat?